If you have decided to open an online store, you must face the question of which secure payment gateway should you choose. Here we will tell you what elements you should take into account.

How to identify a secure payment gateway?

Below we have listed several features that your next secure payment processor must have in order to be safe.

1. PCI DSS regulation

The PCI DSS regulation (Payment Card Industry Data Security Standard) is a security protocol that every company that processes sensitive financial data is required to handle.

It is an international protocol that includes standards for security management within the platform’s architecture, the network’s interface, the software’s design, the data protection policy, security management, and password handling.

It is a regulation that is updated all the time, so your payment gateway provider must have the most recent version.

2. 3D Secure Protocol

Its effectiveness is based on the identification of the user by means of certification through the SSL system (Secure Socket Layer), which is a program used to carry information back and forth in an encrypted way.

This allows the card issuing bank to verify the user’s identity by requesting certain data, including some that only the card holder should know. Once this information is verified, the next step would be the payment. The store never knows what information the customer has been requested.

3. Tokenizing the information

Another important element that the payment gateway service should offer is the tokenization of your customers’ sensitive information.

This consists in changing the information into a series of random numbers that apparently do not make any sense. Additionally, they cannot be reversed to be translated into the original information if they fall into the hands of third parties.

These random numbers become the information that is handled within the business operation. This technology drastically reduces the number of systems that can access your customers’ sensitive data.

4. AVS system

This security protocol automatically links the card holder’s legal address to each transaction. By assigning a physical address and verifying it in every transaction, the possibility of fraud is significantly reduced.

How does it work? When your customer is on the billing page of your website, your website will ask for a billing address. If this address does not match the one the card holder gave the bank at the time of registration, the transaction will be rejected.

The system works with national and international AVS, depending on the card issuing bank. This gives you access to a more globalized market safely.

5. Security certifications

You must have the security certifications issued by experts and world leaders in each specialty. These documents must be the basis of permanent security audits for all the systems involved in the platform.

PayRetailers, for example, holds audit certifications that demonstrate their platform is updated frequently so as to provide the latest developments in security and sensitive data protection to your users.

6. VIP client lists

The latest platforms for payment gateways are intuitive. They use artificial intelligence to separate suspicious customers from those that are recurrent and more loyal to your store.

The system will separate customers depending on the profile of their purchases and will assign those with the greatest conversion potential facilities to interact.

What is the safest payment gateway? It is one that combines its technology with your store’s requirements and your customers’ profile.

A complete list of the best e-commerce payment platforms

Payment Gateways vs. Payment Processors: What’s the Difference?

The main difference between payment gateways and payment processors has to do with the moment of their running during the transaction between a customer and your store.

Payment gateways

Payment gateways start working from the moment the customer enters the data in the checkout screen. The gateway encodes the data entered by your client and sends it to the bank that issued the card. It waits for the bank’s response and then notifies the store about the transaction.

As in an online transaction there is no physical presence of the customer’s card, the payment gateway is in charge of playing the role of the chip reader or payment terminal found in physical commercial premises.

Payment processor

Once the payment gateway has collected your customers’ information and sends it to the issuing bank, the payment processor comes into play. As its name suggests, it handles gateway payment processing.

Once the issuing bank, the one that has issued the customer’s card, has given a positive or negative response to the transaction, the payment processor sends that information to the acquiring bank.

In digital transactions, the payment gateway acts as a point of sale or payment terminal when collecting card and customer information. Once collected, it send it to the card issuing bank and this one reports the negative or positive response through the payment processor.

If the transaction has been approved by the issuing bank, the response is also sent to the acquiring bank to process the funds involved in the transaction.

Thus, while the payment gateway collects customer information, the payment processor is the platform in charge of carrying it to all the parts involved in the transaction.

Online API payments: how to choose the perfect one for you?

Secure Payment Gateways of 2021

1. PayRetailers

It is a Brazilian gateway that operates in 12 countries in Latin America, where it offers more than 250 payment methods. This useful as the customers of your online store have a wide range of options to cancel their invoices.

Its advantages include duly certified security mechanisms and the concentration of its operations under the same service provider and a single API, which provides greater control of its operation.

2. PayU Latam

It is a subsidiary of the North American company PayU and one of the largest in the market. It excels in businesses related to tourism, technology and entertainment. In Latin America it is available in Argentina, Colombia, Chile, Mexico, Panama and Peru.

3. PayPal

Since it is in the market since 1998, it defines itself as one of the pioneers. It offers its business customers the possibility of a cash refund in some cases of fraud and uses advanced encryption systems.

4. Stripe

It has gained a lot of ground among the so-called startups because of its competitive rates. Its API has a great reputation among its customers thanks to its simplicity and maneuverability.

5. Paycomet

It is a payment gateway that began in 2010 and, since then, its commitment to innovation is supported by the security of its transactions. This is where it greatest efforts have been aimed at.

Secure Payment Integrations

The English term can be translated as ‘secure payment gateway integration’ and means the resolution of several challenges when integrating payment gateway systems with payment processors.

This integration should be easy for the customer and seller to use, offer different payment methods, support different currencies, and be secure.

An effective integration of the system lowers customer churn rates and increases conversion rates. The payment gateway must have that.

Online payment integrations: how much does it cost and documentation

Need to know: Shopify payment security

Acording to the website Rewind: “Shopify provides a secure shopping experience for its merchants’ customers by keeping their security systems up to date with industry best practices.

Payment Card Industry Data Security Standard (PCI DSS) is an information security standard that organizations must adhere to when handling credit card and debit card information. The Payment Card Industry Security Standards Council created this standard to protect cardholder data used for online payments”.

Shopify is certified Level 1 PCI DSS compliant, meeting all six categories of PCI standards:

- Maintain a secure network

- Maintain a vulnerability management program

- Regularly monitor and test networks

- Protect cardholder data

- Implement strong access control measures

- Maintain an information security policy

This compliance is extended to all online stores powered by Shopify.

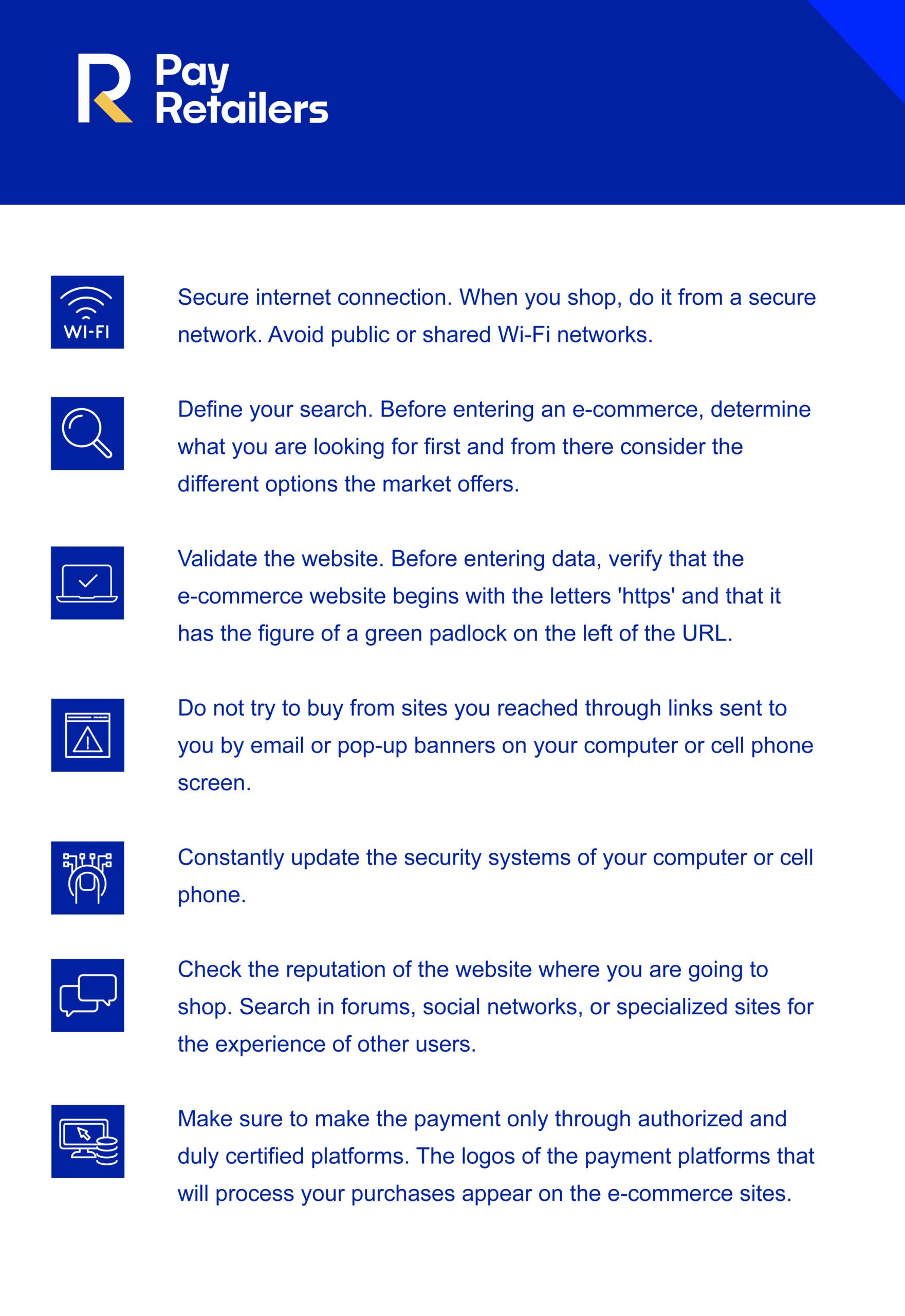

Tips for secure online shopping

The most important thing is to have a gratifying experience. Is it safe to use payment gateways? The answer is yes, as long as the following tips are followed.

A secure payment gateway combines an up-to-date platform with an efficient integration that offers a user-friendly ecosystem.