How much does it cost to have an online payment integration? Is it easy to set up? Here’s what you need to know.

Choosing the best online payment is a crucial and decisive step in the future of your business. Agility, usability, trust, and stability are some of the characteristics that it must have to integrate with your eCommerce platform.

But there are other details that you should consider when you implement it, such as the Payment Request API or the application for payment integration. For example, do most browsers support it? An API can go further, even confirming issues such as the buyer’s online presence or whether the transaction is protected from fraud, among other details.

We are talking about security for the buyer and for the seller, and the parameters that you need that an API complies with so that the integration with your payment gateway is as efficient as possible because in the end the APIs oversee enriching any digital system.

5 reasons to use an e-wallet

What is the best and suitable integration method?

It varies. One of the main topics to consider is the ease with which the API payment system can be integrated with your e-commerce. It is not a bad idea to enquire with the different Payment Gateways Providers what are the solutions that each of them offers for your business.

Also, they are data methods for example data safely. However, returning to the specific question, there are a variety of payment methods, we are able to talk about three of them:

Hosted gateway

A hosted gateway is a payment gateway hosted in your own eCommerce. When the user decides on a product or service and decides to buy or pay for it, they will be redirected to a PSP page to make the payment.

It is there where you must enter your personal and payment data and then be redirected again, to your website once the payment has been made. It is a method known to most users and is reliable but since the customer is redirected to another page for payment, the merchant can’t control the entire user experience.

Direct Post method

With this option, the form with the payment details is on your server, but the payment is made through the payment gateway, where the data is directed and where, finally, the transactions are done.

It is a good method if you are looking to keep your company’s brand quite visible. Also, you don’t need a PCI-compatible website.

Non-hosted (integrated) method

If you are looking to have full control over a user’s shopping experience, this is the most effective method, since the user enters their debit or credit card information directly in their eCommerce. Then process the payment using some HTTPS queries or using the APIs. Staying on your own business page gives buyers more confidence.

Choosing a payment gateway provider

The world of brick-and-mortar stores is in the past, still existing, but past. Now the buying and selling of service products over the internet are on the rise. In addition, the COVID-19 pandemic accelerated the process even in countries where this model was not yet strong.

What does a payment gateway need to do? How to test payment api? Simple: allow the customers to pay for the product or service they want in a quick and easy way. Keep both the money and customer information safe. And that makes you gain the trust because, in the end, they are giving you their money.

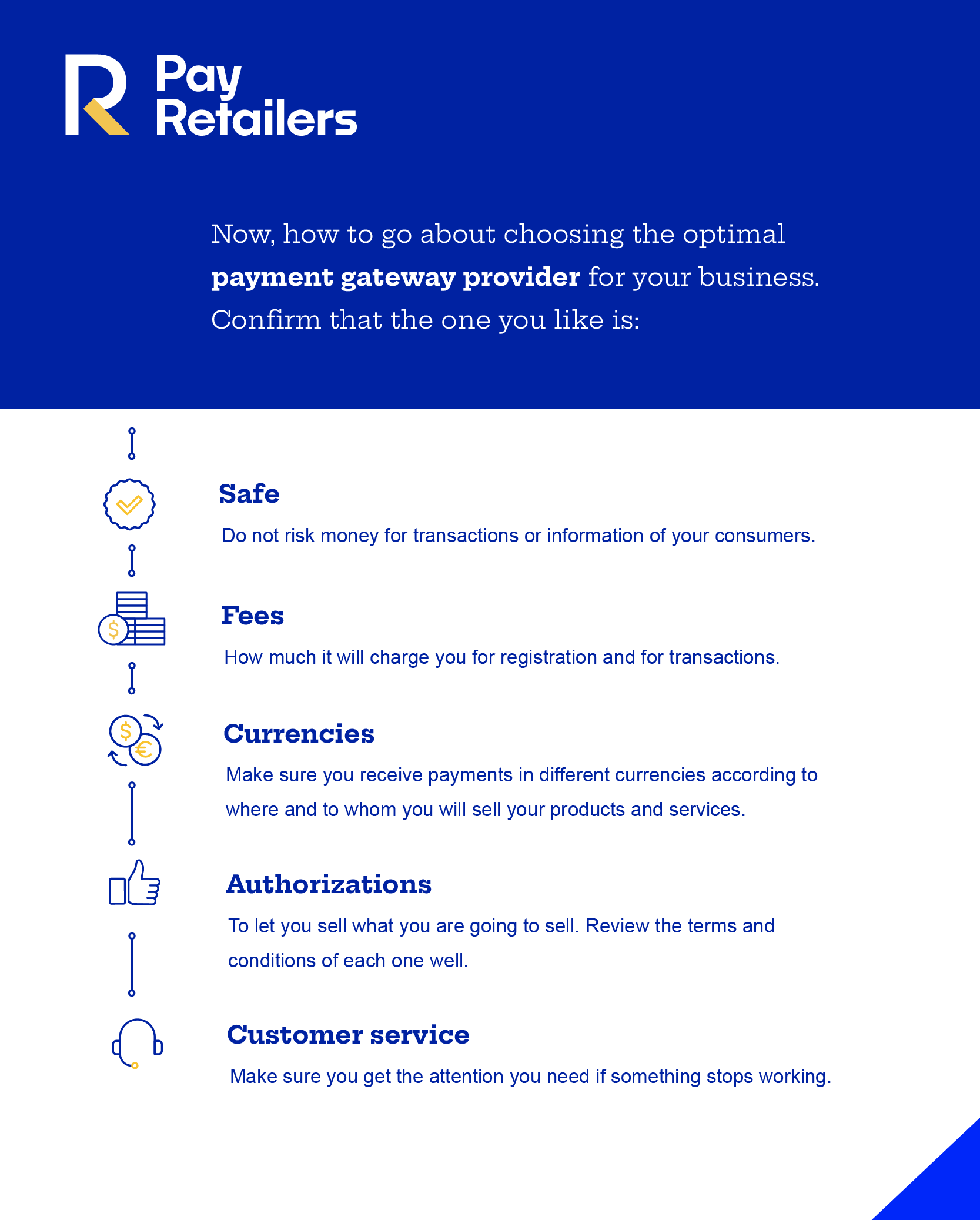

Now, how to go about choosing the optimal payment gateway provider for your business. Confirm that the one you like is:

Now, how to go about choosing the optimal payment gateway provider for your business. Confirm that the one you like is:

- Safe: do not risk money for transactions or information of your consumers.

- Fees: how much it will charge you for registration and for transactions.

- Currencies: make sure you receive payments in different currencies according to where and to whom you will sell your products and services.

- Authorizations: to let you sell what you are going to sell. Review the terms and conditions of each one well.

- Customer service: make sure you get the attention you need if something stops working.

Most popular payment gateway providers

An article published by The Balance Small Bussines listed the best payment gateways so far in 2021. These are:

- Best Overall: Authorize.Net

- Runner-up: Stripe

- Best for online business: PayPal

- Best for Brick-and-Mortar Businesses: Square

- Best for startups: Braintree

- Best for multiple channels: WePay

- Best to sell internationally: 2Checkout

However, there are other lists, in which the following are always mentioned: PayPal, Amazon Pay, Stripe, 2CheckOut, and Authorize.net.

Is it possible to build a custom gateway?

Yes, of course, but you should consider not only the investment in its development but also in its maintenance.

With your own payment gateway, you save the transaction fee, but is it enough savings to decide to create your own payment gateway?

The certification and integration process can be time-consuming, generating delays or even stopping your sales process.

There are options on the market that provide an adequate response to your needs, without having to incur major expenses.