API credit and debit card payments: What is the best for you and your business?

Did you know that there is a solution to improve the e-shopping experience? We are talking about credit card APIs that are part of payment APIs. If you want to learn more about this electronic payment method, read on.

Fleshing out your payment form

What is a credit card API? A credit card API is used in e-commerce for the purpose of charging credit cards. The entire process is highly secure, as the customer’s and seller’s data is encrypted by a security system.

Payment services APIs

Payment services APIs work by interacting with your code through one or more JavaScript objects which serve as containers for the data used by the API and its features.

The main purpose of these payment platforms is to allow the buyer to pay with several payment methods — not only with credit cards but also with debit cards and/or bank deposits.

Thus, using payment services APIs significantly improves the flow of the user’s purchase process. This represents a benefit for both the user and the seller.

APIs are handled through open standards, allowing compatibility with an array of browsers. In that sense, traditional checkout flows are replaced, allowing merchants to accept any payment method.

These are some of the objectives for which payment gateways have been created:

- The browser acts as an intermediary between customers, sellers, and payment methods.

- They seek to standardize the payment flow.

- They support different payment methods, and they do so securely.

- They work on any platform or electronic device.

Online payment integrations: how much does it cost and documentation

APIs at Visa

Perhaps you have known one thing about an api, and that is: What is API in visa? One of the leading examples in the world of API development is Visa Inc., which has launched Visa Developer.

This is a software platform that offers direct access to hundreds of APIs and software kits in order to make commerce faster and safer.

Through this platform, financial institutions, retailers and technology companies help each other to meet the demands of shoppers and retailers. This is increasingly becoming a necessity as e-shopping emerges as the primary form of consumption.

Facilitating all processes is one of the characteristics of this platform. Not only is it simpler to buy and sell, but also to create a Visa API account. You just need to create an account and check your connectivity.

Is PayPal an API?

Of course! PayPal is one of the most popular payment APIs. Founded in 1998, it now has more than 220 million active accounts worldwide.

Through this payment gateway, you can receive and request payments. Its web design is user-friendly and one of its greatest benefits is that it has a commission plan for non-profit organizations.

PayPal API features are based on functions such as bulk payments, invoicing, bank transfers, and subscription.

Payment forms

One of the main problems of online shopping cart abandonment is due to payment forms.

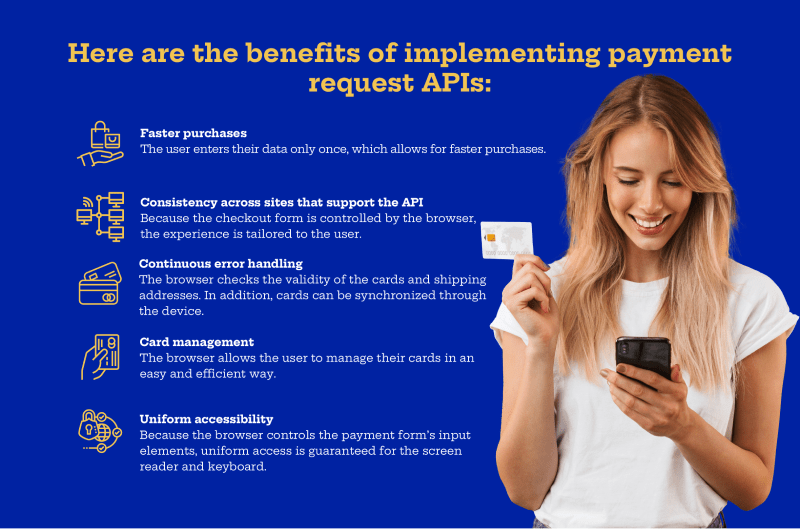

Complicated forms are too time consuming, causing the buyer to become despaired and, consequently, not complete the process. Payment request APIs significantly reduce the number of steps required to complete the purchase.

The end goal is to potentially eliminate purchase forms. All this is achieved thanks to the implementation of software that automatically remembers the user’s data, aiming to not require an HTML form.

When a payment request comes about, the website generates the PaymentRequest, responding to the user’s action when they clicked “buy.” The PaymentRequest allows the website to exchange user-agent data while the user supplies the information to complete the payment.

Let JavaScript do the job

Let’s talk about JavaScript. Java is a programming platform that uses the programming language called JavaScript.

In that sense, JavaScript has many APIs available, built on the core of this programming language. To explain this idea better, let’s say it’s as if you were granted additional superpowers when you use your code.

There are many different Java APIs: APIs for manipulating documents, audio and video APIs, APIs for manipulating and drawing graphics, etc.

However, we are interested in addressing client-side storage APIs. The JavaScript API allows you to store client data (on the user’s machine) and then recall it when needed. Normally, client-side and server-side storage are used together. This allows for synergies and convenient information flow.

Some of the uses of this software are:

- Customization of site settings.

- Saving local information to make the site faster.

- Saving documents generated for offline users.

- Recall of previous site activity.

Processing the credit card data

Now we’ll talk about what credit card processing is. This process begins with the generation of the PaymentRequest, which transmits all the information necessary to complete the purchase to the browser.

The browser will determine if the payment method is accepted for the website, as well as the methods installed on the target device.

The advantage of using a credit card is that it is a simple payment method. The browser saves the card and this makes future purchases easier. This is not the case, for example, with so-called “third-party” payment methods created specifically for payments to be made to the site.

Once the user has authorized the transaction, the data is sent directly to the site. Regarding payment by credit card, the information received by the website is the following: the card number, the cardholder’s name, the expiration date, and the CVC.

In the event that you want to show the user the form at the end of the purchase, it is possible. This allows the consumer to feel more secure, as they can review the details of their purchase at the end.

What are omnichannel payments and why are they beneficial?

Getting your first payment

Thanks to the multiple interfaces developed in payment APIs, it is extremely easy and secure to receive payments. With the PaymentSearch interface, you can easily search for payments.

In addition to PaymentSearch, there are other interfaces that can be enabled, depending on your requirements: PaymentAddress, which is used for billing and shipping, or PaymentResponse, which is enabled after the user selects a payment method — and many others.

Get paid swiftly: the way you want it

This tool makes life easier for the customer and also for the website owner. Payment APIs are the best alternative to receive payments quickly.

A transaction that is performed using a payment API is called an API transaction. The goal is to make this transaction simple and to have the payment processed in a quick and easy way.

As we have already seen, Payment APIs are increasingly in demand due to their numerous advantages and benefits. One of their most important advantages is that they help protect against potential fraud and data breaches.

How do you implement a payment API?

If your goal is to sell services or products over the internet, having a payment API is of utmost importance.

There are many options on the market and you should know that nowadays hiring or developing a payment API is affordable and viable for your business. The only thing we advise you to do is to look for developers who have experience in the area so as to avoid unlucky surprises.

So, if you’ve already decided to implement a payment API, we recommend services like PayRetailers.

PayRetailers are developers who have solutions for different types of customers, and they also have experience. What’s more, thanks to the use of a single API platform, you won’t need to implement additional developments.

Credit card APIs in particular and payment APIs in general are the best strategy for online transactions. Don’t get left behind and implement them in your online business today!

What are embedded payments and what are they for?

FAQs about credit card processing api

What is credit card API?

A payment gateway API is an interface that allows developers to integrate payment functionality into their applications or websites. The payment gateway is the intermediary between the merchant and the payment processor, allowing payments to be made securely and easily.

What is API payment?

A payment gateway API is an interface that allows developers to integrate payment functionality into their applications or websites. The payment gateway is the intermediary between the merchant and the payment processor, allowing payments to be made securely and easily.

What is API debit card?

The Credit/Debit Card API allows processing credit card and debit card transactions with CVV of a previously registered order with the possibility of tokenization. As a prerequisite to use this service, you must have an order created. To do this you can make use of the collection API.